Top 20 Global Mobile Apps in November | Dual Short Drama Launch Champions Propel ShortMax to the Top, Meanwhile ChatGPT Leading the AI Revolution

SocialPeta sorted out the top 20 global mobile Apps by advertising, revenue, and download in November 2024, hoping to be of assistance to more people in the mobile app industry who are trying to understand the changing trends of the global mobile market.

The overall performance of global mobile Apps in November:

- Dual Short Drama Launch Champions Propel [ShortMax] to the Top;

- [Trip.com] Aims for Year-End Victory, with Over 180K deduplicated ad creatives Competing for champion;

- Pure Version of Twitter, [Bluesky], with Explosive Growth, Doubling in Downloads.

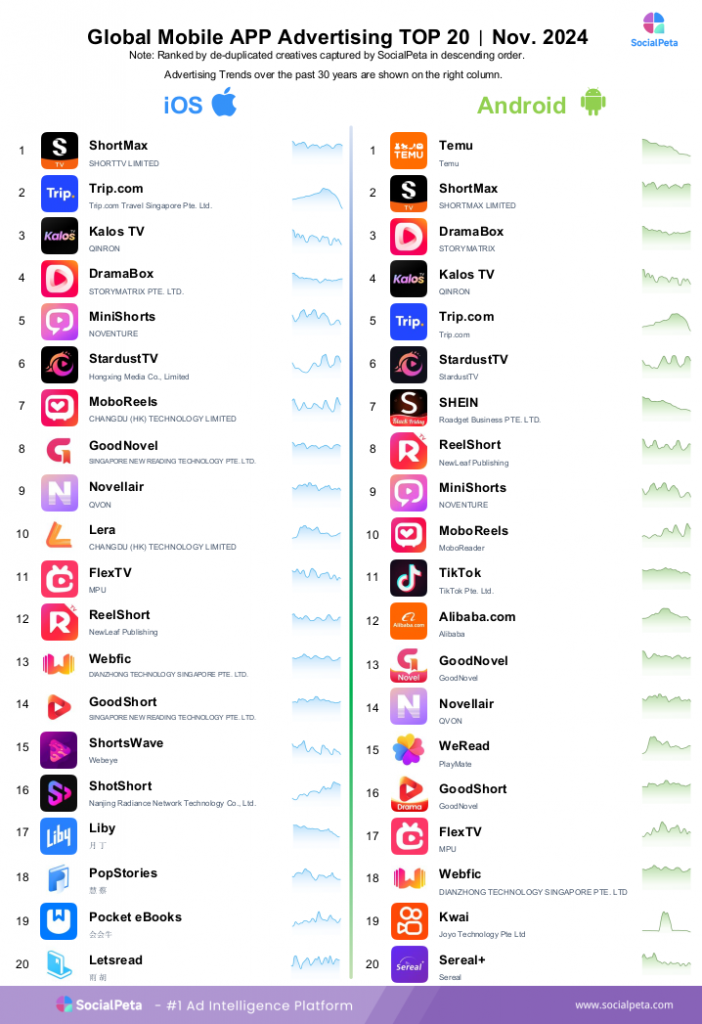

Top 20 Mobile Apps by Advertising

The continued development of short dramas has transformed the app rankings, now dominated by short dramas and online literature. However, there are still some standout products from other sectors.

[Trip.com] saw a significant surge in campaigns, with iOS campaigns now reaching second place. Short video apps continue to hold their position on the list, with [TikTok] and [Kwai] ranking 11th and 19th on Android, respectively. The top spots are still held by [ShortMax] from Jiuzhou Culture and [Temu] from Pinduoduo, both seemingly aiming to cement their dominance through global campaigns.

First, let's look at Jiuzhou Culture's [ShortMax]:

As the most diligent among the three major giants, [ShortMax] launched several popular short dramas in November. Among the top 50 short dramas in terms of campaign volume, 13 came from [ShortMax]. According to SocialPeta, [ShortMax]'s campaign performance in November was as follows:

- Over 308,000 deduplicated ad creatives across both platforms, with 89.0% of the creatives being newly launched;

- The number of image creatives was just over 500, with the majority being video creatives;

- Campaigns were run in 76 countries/regions, with the top regions being the United States, the United Kingdom, Germany, Canada, and France;

- [ShortMax] achieved significant success with two drama campaigns in November. One was the Japanese short drama "大富豪のバツイチ孫娘," which has been mentioned several times. Despite topping the weekly campaign rankings in October, it maintained a high campaign volume, generating ongoing momentum. The other was "The Rejected Luna Returns with a Son," led by our familiar male lead, which topped the monthly campaign rankings in November with over 15,000 deduplicated ad creatives.

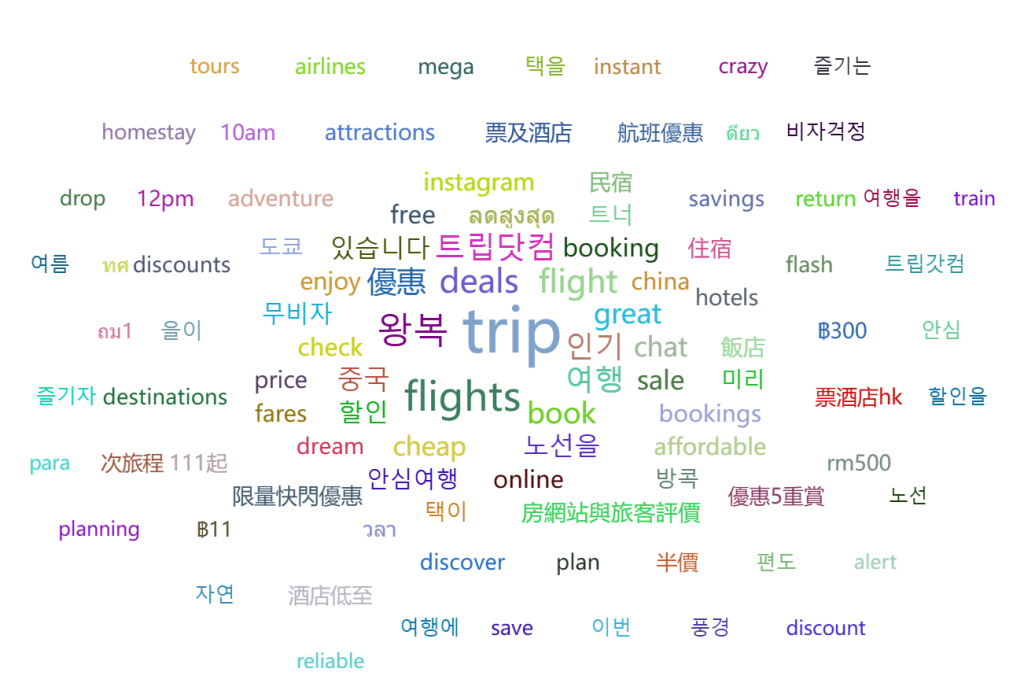

Trip.com ramped up its campaign efforts again in November, likely in preparation for the upcoming December events such as Christmas and New Year's celebrations. Given this, campaign volumes are expected to surge again in December. Let's take a look at its campaign performance in November:

- Over 187,000 deduplicated ad creatives across both platforms, with approximately 78.6% being new creatives;

- Campaigns ran in 76 countries/regions, with Hong Kong accounting for the highest proportion at around 10.41%;

- Over 51% of creatives were image-based, primarily using bold text to emphasize the brand's professionalism;

- High-frequency keywords in the copy were closely tied to transportation, hotel bookings, and promotional discounts. In addition to the keyword "Trip," "Flight" appeared most frequently.

Finally, let's look at [Kwai], which has not appeared on the rankings for a long time. [Kwai] began its campaign efforts in March 2018, primarily focusing on the Android platform. Until now the number of deduplicated creatives has exceeded 580,000. According to SocialPeta, its campaign performance in November was as follows:

- Over 22,000 deduplicated ad creatives across both platforms in November, with the majority being video creatives. The few image creatives that were used mainly promoted [Kwai Shop], similar in style to those of e-commerce apps;

- Key markets for November included Brazil, Portugal, and Singapore, with 98% of creatives targeted at Brazil, and Portugal and Singapore accounting for 73% and 33%, respectively;

- Recent hot creatives analysis: The popular creatives on [Kwai] are mainly comedic sketches performed by real people. Compared to Chinese trends, it appears the only real difference is in the ethnicity and skin color of the performers. It seems that, no matter where you are, quirky humor always captures the audience's attention.

Top 20 Mobile Apps by Revenue

Top Revenue-Generating Products on App Store in November are:

In November, the revenue of major products showed a slight decline, but on the App Store side, [ChatGPT] withstood the pressure and achieved a reversal, with a growth rate of approximately 4.6%. Considering the rumors that major companies are optimizing their workforce by replacing employees with AI, it is expected that [ChatGPT]'s revenue will continue to grow in the future.

Outside the rankings, several products are making significant strides and experiencing revenue surges:

- [X], despite ongoing criticism due to Musk's controversial actions, has seen a notable increase in revenue, rising by approximately 22.1% in November;

- [iQIYI] experienced a substantial revenue boost in November, with a month-over-month increase of 54.5%. Notably, regions such as Thailand, Taiwan, and the United States contributed over $700,000 in revenue;

- Short drama platform [NetShort] has begun its resurgence, with a remarkable month-over-month revenue increase of 221.8%. If this trend continues, it may make its way into the rankings in December.

Top Revenue-Generating Products on Google Play in November are:

As Christmas approaches, more users are shopping on [Amazon Shopping], with Google Play seeing a growth of approximately $1.5 million in November compared to last month.

Top 20 Mobile Apps by Download

Top Downloaded Products on the App Store in November are:

The streaming platform [Netflix] has actively embraced the gaming platform strategy, which has helped it withstand pressure. In November, its downloads increased by approximately 13.7%. With the exclusive launch of [Monument Valley 3] in December, the upward trend is expected to continue.

The pure version of Twitter, [Bluesky], has seen explosive download growth, with an impressive 221.4% increase, securing the 19th spot on the rankings. If its features continue to improve, it may be able to rival [X] in the future.

Top Downloaded Products on the Google Play in November are:

Google's new regulations led to the removal and rectification of several live-streaming apps, which in turn stimulated the download growth of other types of social apps. Among them, [Facebook] saw the highest increase, reaching 38.7%.

In addition, Google's own AI product, [Google Gemini], experienced a download growth of 33.1%, surpassing [Meesho] to secure the 16th position on the rankings.

The above are insights into global mobile games in November 2024, as well as mobile game revenue and download situations across both the App Store and Google Play. For more mobile marketing data, please visit www.socialpeta.com.