Casual Games Monetization Tips:Think and Reach Farther

Games nowadays thrive and get eliminated at an increasingly faster rate. After a spell of barraging by a series of “loaded” games, starting in 2018, gamers can finally catch their breaths through the emerging casual and hyper-casual genres. According to the 2018 Game Review Report, the majority gamer population by genre has now shifted toward the patrons of casual games, accounting for up to nearly 60% of the total community in Q3. Owing to their intrinsic advantages, such as having short development cycle, low cost, its lightweight nature, low threshold, and fast iteration, etc., the marketing and realization of casual games have also shown off their unique charm, which is undoubtedly the driving factor that makes the casual genre a dark horse this year.

The Rise of Casual Games and the Strong Revenue-Generation Capacity of Advertisements

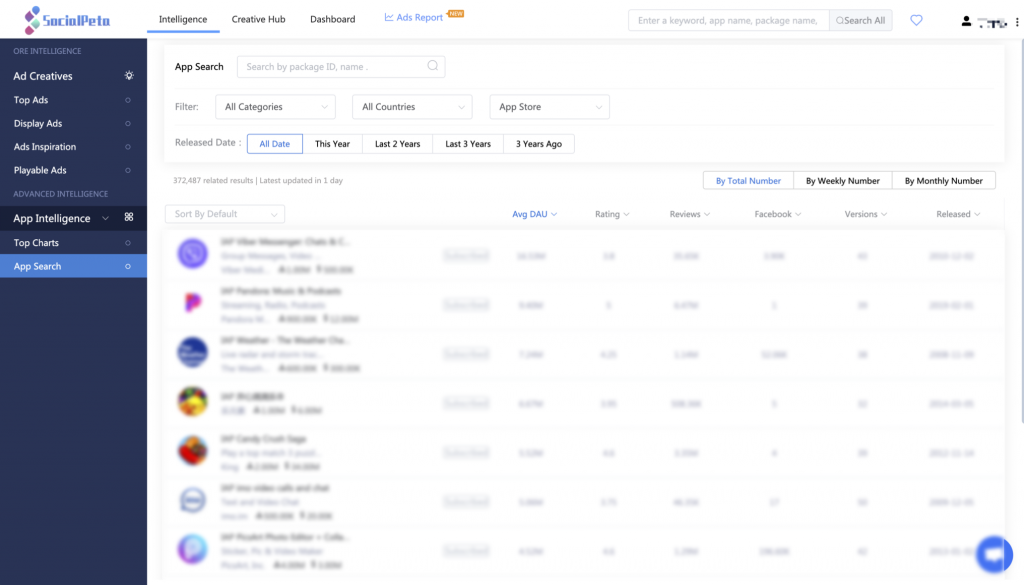

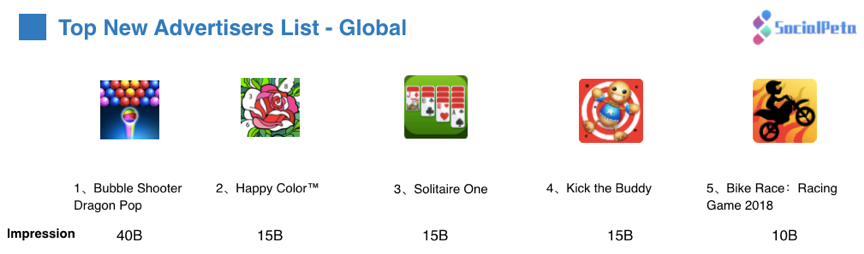

According to the statistics provided by SocialPeta, an independently developed and a world’s leading advertising intelligence analysis tool, on the list of the world’s top game advertisers in the first half of this year, the top five positions were all occupied by casual games, and there were more puzzle games and action/playground games than other genres on the list. Tencent also once pointed out that the critical juncture for the rise of the casual game market in China was in 2019, boasting a market scale that accounts for about 7% of the domestic mobile game market.

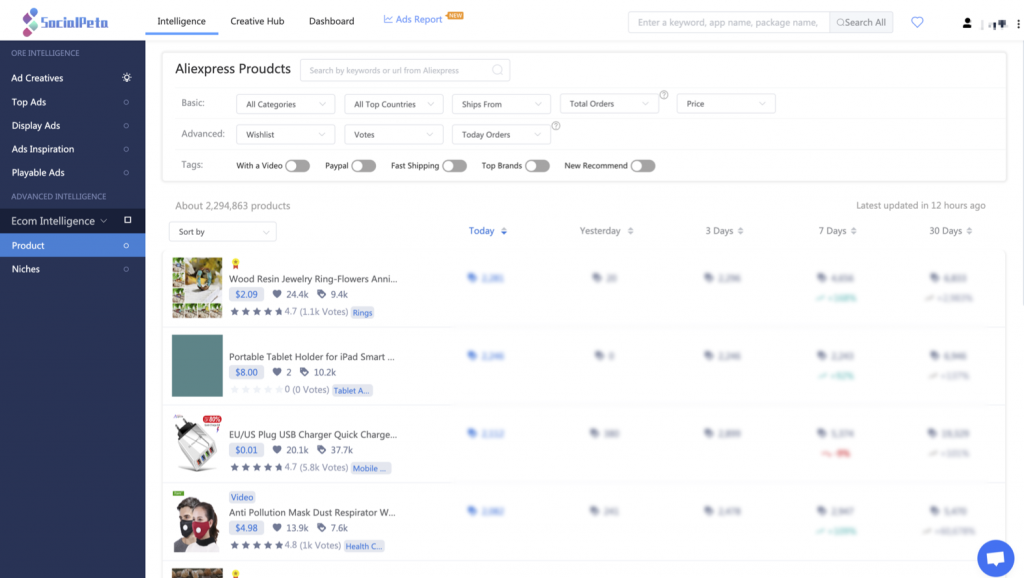

At present, most of the marketing approaches of casual games rely on in-game advertising and going global, paving the way for ad monetization to become the main source of revenue. According to the backstage data from SocialPeta this year, 16% of the casual games accounted for 24% of the advertising creatives, which means any advertising creative can enjoy a large placement frequency in casual games. When Archero was released overseas, it attempted two monetization models, i.e., advertising and internal data monetization, and came up with a big victory. In June, it became the iOS game that enjoyed the highest advertising share via Facebook in North America.

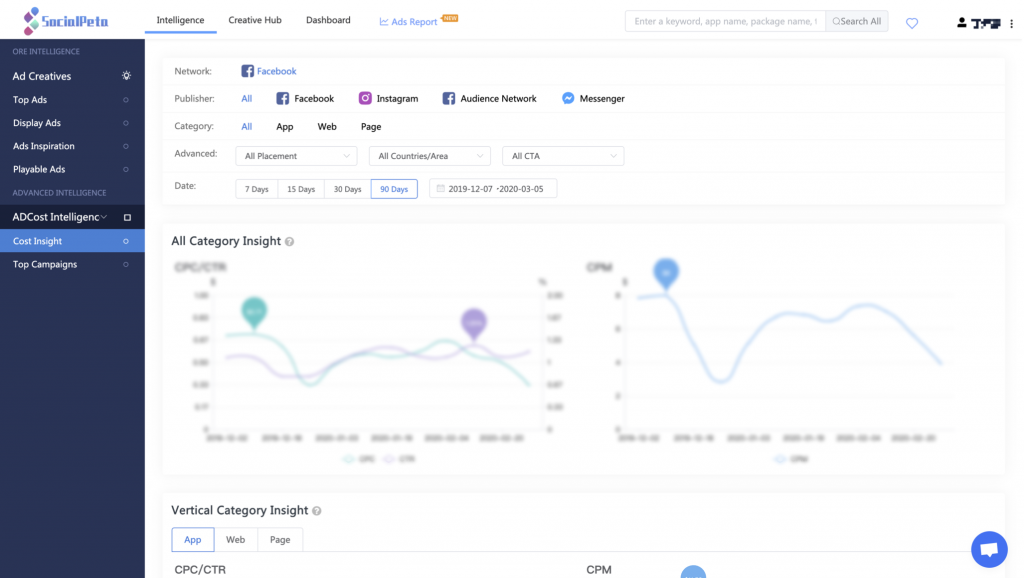

According to the advertising creatives of Archero acquired from the backstage data of SocialPeta.The overall rise of casual games in the in-game ad monetization market also leads to increasingly fiercer competition in this field. The key point of this competition lies in eCPM, i.e., the revenue that can be obtained for every 1000 exhibition, which is an indicator of how much profit the game company can obtain from its monetization strategies. Therefore, casual games have higher requirements for creative advertising creatives relative to other game genres. In addition to that, there is also a need to guarantee the output quality and quantity, the accurate use of networks, as well as how much it resonates among its users.

Center Decisions on Customers’ Demand, and Operate with Long-Term Goals in Mind

After the market pattern was broken by casual games, some large-scale game developers begin to consider joining the fray, such as the Electronic Soul, Leiting Games, Duoyi Network, 37 Interactive Entertainment, etc. Compared with the companies that fully dedicated themselves to developing casual games, these “more inclusive” game enterprises pay more attention to their long-term development by attempting to gain deeper insights into their customers’ demands. This move may also serve as a reference for the “lightweight” casual game developers.

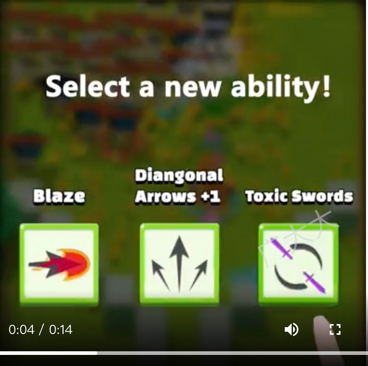

In the stages of launching, promotional expansion, and retention for casual games, different marketing strategies and advertising ideas should be formulated according to the psychological demands of different users, and specific incentive mechanisms should be set whenever necessary. Teasers and playable ads are often used in the early and intermediate stages to guide the users into experiencing the fun and controls of the game over a short period of time, while in the later stage of retention, “incentive” video ads and efforts to sway the interests of medium- and large-scale gamers are mostly adopted to maintain the provision of value to users.

According to statistics, hyper-casual games occupied the top ten positions of the iOS Global Game Download List in May, with a DAU as high as 3.5 times the industry’s average, and web sessions taking place as often as 5 times that of other genres. Although the total download and installation volume of casual games are satisfying, it is still lower than that of medium- and large-scale games in terms of non-natural installation volume. According to the Global Mobile Game Market Data Report in the First Half of 2019 issued by AppsFlyer, the non-natural installations of casual games and medium- as well as large-scale games during Q2 were 38% and 54% respectively. In other words, the developers didn’t invest much in in-game advertising and promotion.

From the

perspective of industry data provided by SocialPeta, which is committed to

boosting the empowerment of enterprises, improving the advertising reach and

users’ retention rate is still the focus and challenge in the marketing of

casual games. Prospective Industry Research Institute stated that 30-day users’

retention rate of casual games in China would remain at about 10% from January

to June 2019 and that there would still be much room left for development in

the future. If the 30-day users’ retention rate can reach 20%, then the revenue

earned by the game developers will look more ideal.