SocialPeta & Smadex Release Mobile App White Paper: Creative Strategies Reach New Heights, Short-Drama Impressions Surpass 2 Billion

Over the past year, global mobile apps have seen rapid development, with short dramas and AI apps thriving. The industry has shifted from an exploratory phase to one of explosive growth, with both new and established players achieving remarkable success in expanding their global reach.

To support global marketers, Socialpeta has continuously refined and updated its products throughout the year. Notably, we introduced dedicated sections for short dramas and AI, offering more tailored and in-depth services. Additionally, we’ve summarized key trends and emerging markets for global marketing in 2024. In collaboration with Smadex, we are proud to present the 2024 Global Mobile Apps Marketing White Paper, which provides a data-driven analysis of global market opportunities. The report also features insights from industry leaders at Zorka, Pushwoosh, Mobupps, Newton, and Trophée.

Key Takeaways:

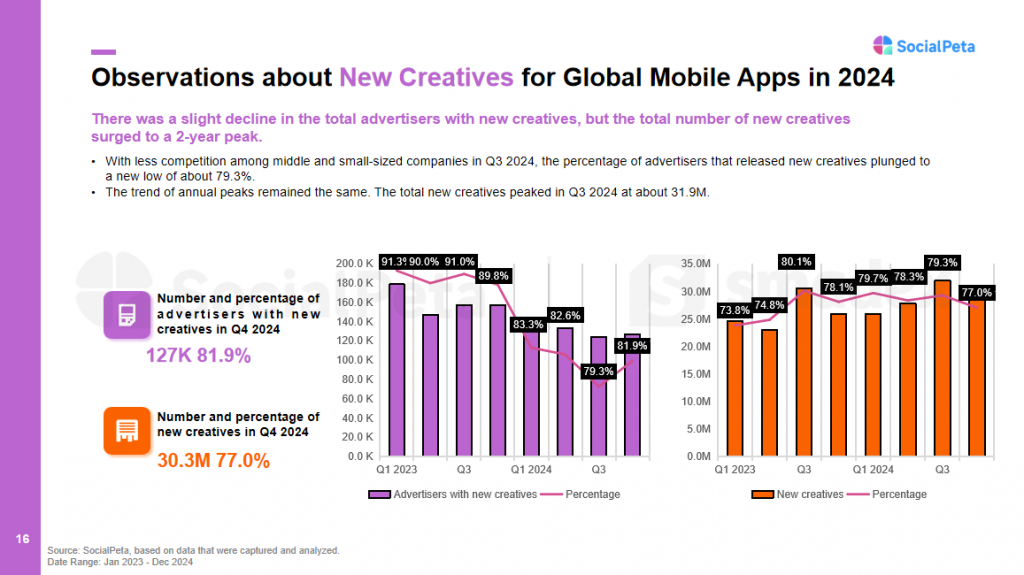

- Record-Breaking Total Creatives: Over 31.9 million new creatives were launched in Q3, setting a new two-year record.

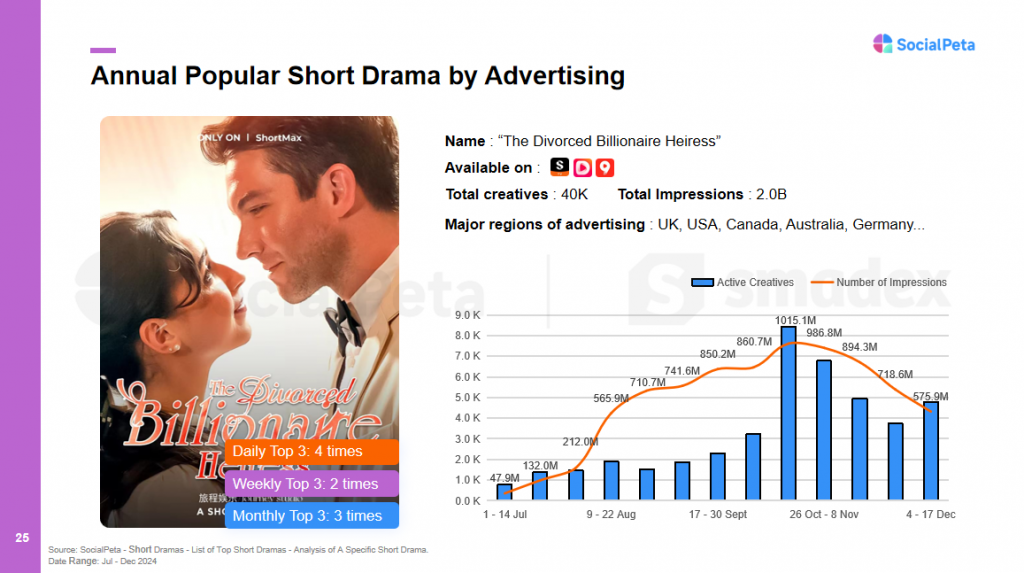

- Short-Drama Impressions Surpass 2 Billion: With more than 40,000 creatives, short-drama content claimed the top spot in advertising, amassing over 2 million total collections.

- Intensified Competition in Japan and South Korea: The region saw the highest year-on-year growth in creatives, with the most intense competition during the summer vacation period.

- Rising Proportion of iOS Creatives: The proportion of iOS creatives surpassed 40% in 2024, outpacing the total number of creatives from previous years.

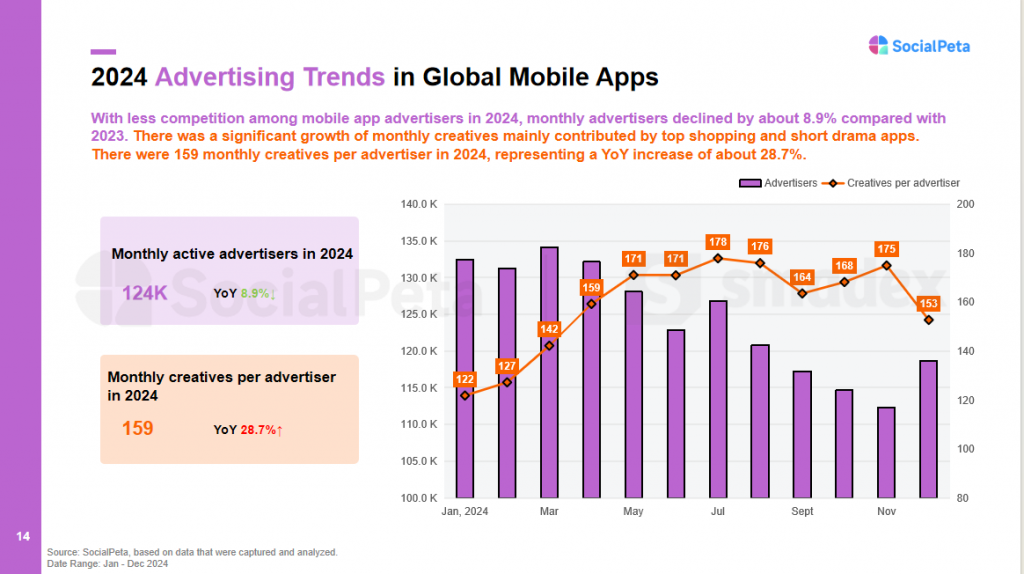

Average Monthly Creative Growth of 28.7%, with New Creatives Reaching a Two-Year High

An Overview of 2024 Data: Competition among mobile app advertisers has slowed, with the average number of advertisers per month dropping by around 8.9% compared to 2023. However, there has been a significant increase in the volume of creatives, largely driven by the rapid expansion of leading shopping and short-drama apps. In 2024, the average monthly number of creatives reached 159, representing a year-on-year growth of approximately 28.7%.

The global mobile apps market in 2024 has seen new trends in advertising. While the total number of advertisers has slightly declined, the volume of new creatives has surged to a two-year high, reflecting a growing enthusiasm among advertisers for content innovation. Specifically, competition among small and medium-sized companies has slowed down in 2024, particularly in the third quarter, when the proportion of advertisers deploying new creatives dropped to around 79.3%. However, looking at the entire year, the third quarter marked the peak in new creative deployments, with approximately 31.9 million creatives, making this period a key moment for mobile apps to dominate the global market.

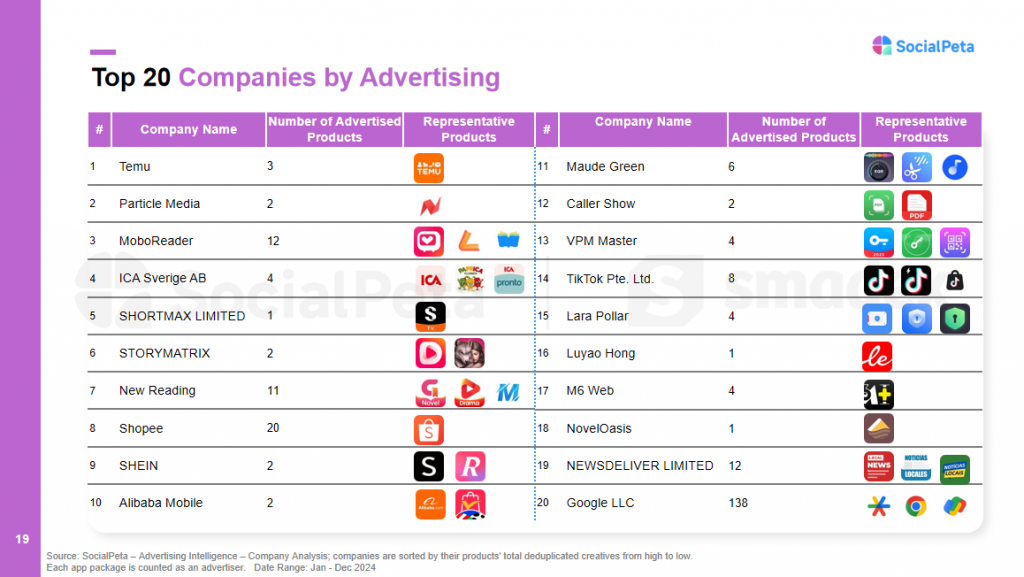

In 2024, the company with the highest number of creatives was Temu by Pinduoduo, which secured the top three in the monthly advertising rankings throughout the year. MoboReader, after venturing into short drama, aggressively scaled up its campaigns, using a strategy of creative saturation with mature translated dramas, generating significant reputation. Other companies in the same category included Dianzhong Tech and New Reading,etc. Google LLC ranked 20th with 138 deployed products, demonstrating its broad coverage and diverse product line in advertising.

Hit Dramas Rely on Advertising for Viral Reach

2024 has been a year of rapid growth for the global expansion of short dramas, with both established and emerging platforms competing fiercely. The top advertising platforms remain the same key players as in previous years, including ShortMax, DramaBox, MoboReels, Kalos TV, MiniShorts, and ReelShort. However, several new platforms have emerged, such as the highly popular global short drama platform, My Drama. In addition to those leading the charge, many large companies have entered the competition internally. For example, ByteDance launched Melolo, aiming to make a significant impact in the coming year.

Even short drama platforms launched by major companies require a substantial amount of high-quality content to achieve widespread popularity. To support this, SocialPeta has compiled a list of the top 10 short dramas of 2024 across regions including Europe, North America, Southeast Asia, Japan, and Korea. It’s clear that in both Europe and North America, most of the top-ranked dramas are local productions, with ShortMax's The Divorced Billionaire Heiress leading the chart, dominating with over 40,000 deduplicated creatives.

The Billionaire’s Divorced Granddaughter, a drama specifically produced for the Japanese market, secured third place on the list. In Southeast Asia, translated dramas dominated the rankings, with The World Treats Me Kindly taking the top spot—this drama is the localized version of a popular Chinese short drama. For detailed insights on the top advertising trends in Japan and Korea, please refer to our White Paper.

Influencer Marketing Generates Over 100 Million Impressions, With 70% Coming from North America.

In addition to short dramas, the special edition also provides an in-depth analysis of AIGC apps. Part 3 of the report explores global marketing trends in social, health, and finance.

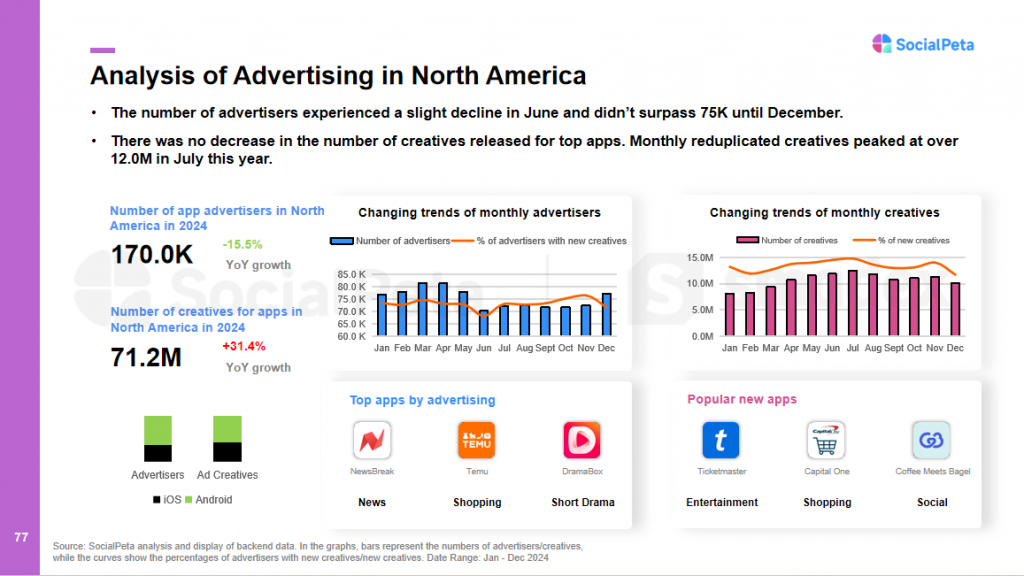

App creatives in North America surged to 71.2 million, marking a 31.4% year-on-year growth.

In Part 4 of the report, we present integrated marketing data from key global regions. Focusing on North America, while the number of advertisers saw a slight decline in June 2024, it rebounded to over 75K by December. Meanwhile, the volume of app creatives significantly increased, reaching 71.2 million, a 31.4% year-on-year growth. Notably, in July, the number of deduplicated creatives peaked at over 12 million. Overall, despite the dip in advertiser numbers, innovation in ad creatives and placement intensity remained strong, reflecting ongoing demand for high-quality advertising content in this market.

Spanning over 80 pages, the report offers an in-depth analysis of five major game genres and valuable insights into key global markets, including the U.S., Japan, South Korea, Southeast Asia, and more. It provides actionable intelligence to help companies navigate the global non-gaming mobile app landscape and fine-tune their marketing strategies for better results.

Download your copy today and stay ahead in this rapidly evolving market.